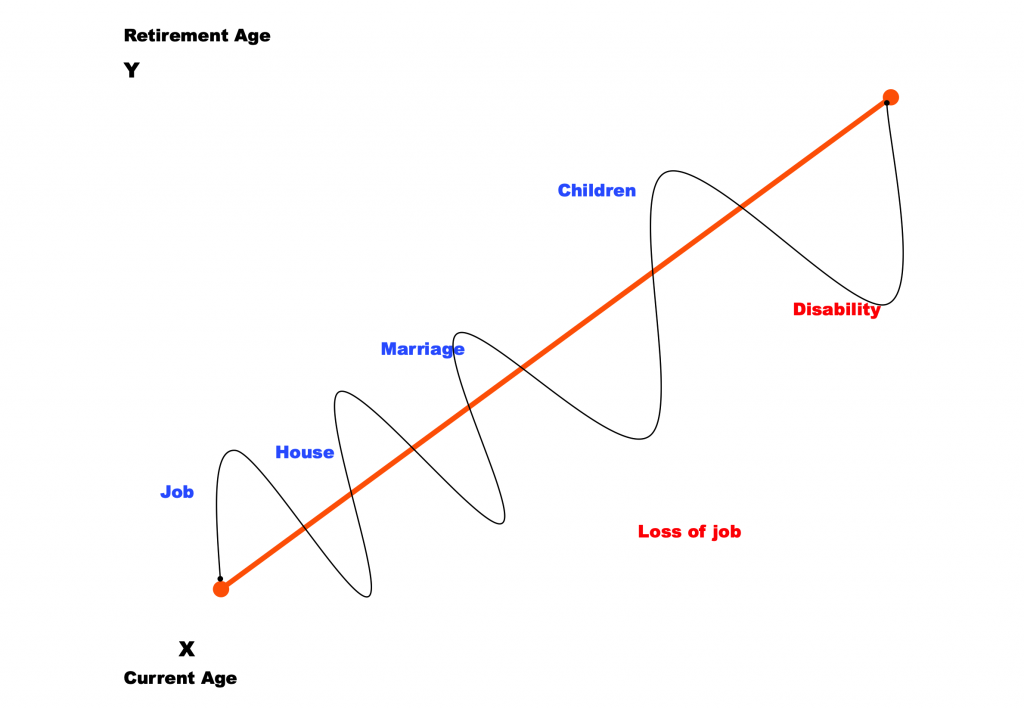

The diagram above shows how the Life style of a Person changes over the years and what are the contingencies he/she faces.

Few Statistics

Retirement

7 out of 10 people endure retirement instead of enjoying it!

Can one imagine living beyond working years on a depleted income, decreasing rupee value and rising cost?

Critical illness

6 out of 10 people do not reach the age of 60 without critical illness!

Can one imagine not being able to provide for one’s family because of illness or not being able to provide for additional medical cost?

Financial Literacy is a critical life skill

One can secure a financially stable future and protect his/her family against all such eventualities by being financially wise and providing for such contingencies.

Major Money Concerns of a retired person

- One of the major concerns is to maintain similar lifestyle as one is accustomed to before retirement. This may necessitate maintaining similar levels of income which could be difficult to do. One may further note that with inflation, the expense amount increases. For e.g. if one spends Rs.30,000/- per month in 2021. The expense for maintaining same standard of living will cost Rs.33,075 after 2 years assuming 5% inflation. Hence the target should be to invest in such instruments which is able to beat the current inflation.

- As elucidated above, spending on health and medicine may increase substantially with advancement of age. Ability to meet such additional expense is a concern.

- Average age of an Indian male is 68 years and that of a female is 71 years. Further, the world over, women earn less and live longer. Hence, it becomes imperative for a male spouse to provide for monetary support to his spouse after his death.

- With advancement of age, it becomes necessary to lay down the principles of distribution of one’s assets (property, shares and securities, bank balances, jewelry, business interest etc.). This is being done through number of options available – making a Gift during lifetime, preparing Will (executable after death), creating a private Trust identifying beneficiaries

- Many a times it is seen that one has taken loans (for housing, for marriage of children, higher education of children) and it is not repaid fully during the working life. Such pending loans are a huge source of concern to a retired person.

- With advancement of age and specially after retirement, risk appetite of a person reduces (and rightly so). This prevents him/ her to invest in riskier asset class (e.g. shares, equity mutual funds etc.) which provides better rate of return on investment. A 15 year (2006-2020) annual return of Nifty 50 is 10.6% and that of Bonds is 6.6%. Thus, Rs.1 lakh invested in Nifty in 2006 would have grown to Rs.4.53 lakh in 2020 as against Rs.2.60 lakh by investing in bonds. This also implies that bigger corpus is required post retirement to maintain same level of income.

- After retirement, a person generally relies on fixed source of income from term deposits, small savings schemes, NSC, interest on loans given, pension etc. However, in the regime of falling interest rates income from such sources witness falling levels. (Interest on 5 year NSC in April 2015 was 8.5% and in April 2021, it is 6.8%. A fall of 15% over 5 years !)

- Another concern is the fear of running out of money! With rising expenditure (specially on health and medicine), impact of inflation, reducing income, advancing age after all the concern is not entirely misplaced.

Ways out of post retirement money concerns

Many of the above money concerns one can easily overcome by being financially literate early in life. An easy to follow guiding principle for all is Earn:Save:Invest:Insure.

I give below the golden rules of being money wise:

- Follow expense budgeting. Instead of wondering where the money goes every month, have control on where do you want your money to be spent. Have a retirement spending plan. Try reducing fixed avoidable expenses.

- Hunt for ways to save without cutting back. Suppose when one is going to market, make a comprehensive to-do list and execute the list in one go. This reduces going out too often and incurring extra expenditure on the same. Afer all, money save is to money earn.

- Look out for investment products providing long term fixed income. Please refer below for investment options specifically tailored to meet the needs of senior citizens.

- Remember inflation. It is like a double edged sword. It increases expense and decreases value of money. It should be one’s goal to beat inflation by being able to invest in products that provide rate of return higher than the current inflation.

- Reverse Mortgage. For asset rich cash poor retirees this is an option. This financial product is offered by most of the banks and few NBFCs. Few salient features of such type of financial arrangement are:

- Borrowers can avail this arrangement by way of lumpsum amount or payable periodically – monthly/ quarterly/half yearly/yearly.

- Available to person with a minimum age of 60 years (if applied jointly, spouse should be of at least 55 years).

- Property should be self-acquired, self-occupied and free from legal encumbrances.

- Loan available for maximum of 20 years for an amount linked to the market value of property.

- Such type of financial arrangement is not much popular in India, as house owners generally like to pass on the ownership to children.

- With the advent of nucleus family and children moving out post marriage, requirement of a bigger house gets reduced. It also makes a good sense to move to smaller house by selling the bigger one. The money earned in the process may well supplement the corpus of retirement. However, such a decision entails facing emotions attached to leaving bigger house with which lot of fond memories remain attached.

- Find out avenues to work. It keeps one agile, mentally and physically fitter (thus keeping medical expenses under check), utilize one’s skills / talent / experience, increases the feel good factor. It may also provide some extra bucks. In this regard the services offered by this website is tremendous and very purposeful to retirees.

- Even though it is advisable for retirees to move to lesser risky investment options, it still makes sense to remain invested in mutual funds (equity diversified and equity oriented hybrid funds). Progressively one may opt for systematic transfer plan (STP) and transfer funds to more conservative types – debt mutual funds. From debt mutual funds one can opt for systematic withdrawal plan (SWP) to fund monthly fund requirement.

- Insurance is a wonderful way to transfer monetary risk to a third person (the insurance company). Hence, always remember to renew on time all the existing policy of insurance – life / health / vehicle / home.

- One may use various financial tools to hone money management skills. Pls refer to the link: http://rightnow.co.in/calc.html

Few of the investment options specifically available for senior citizens are:

| Sl. No. | Name of Product | Interest Rate | Lock-in Period | Max Amt | Income Tax on Interest |

| 1. | Senior Citizen Savings Scheme | 7.40% | 5 year | 15 lakh | Chargeable |

| 2. | Pradhan Mantri Vyay Vandana Yojna | 7.40% | 10 year | 15 lakh | Chargeable |

Few other investing options worth considering

Besides term deposits with banks and AAA rated corporate bonds, few of the other options available are:

- National Pension Scheme (NPS): Under the current rules, one can open an account in NPS upto the age of 65 years and thereafter can extend it upto 70 years. Contributions made are eligible for tax deduction (upto Rs. 2 lakh under section 80CCD (1 and 2) . Investments made can be directed towards –

- Equity

- Corporate bonds

- Government securities

- Auto choice (where asset allocation made by the agency depending on one’s age).

- On maturity one is allowed upto 60% withdrawal (which is tax free) and rest is given by way of annuity (return on which is taxable). Seven types of annuity plans are approved by the authorities and anyone can be opted for.

- Floating Rate Savings Bond: These come with a lock in period of 7 years. Interest rates are set every half year (Jan. and July) and is pegged at .35% above NSC rate.

- Retail investors can also buy online Government Securities. (G-Sec), State Development Loans (SDL) and Treasury Bills (T-Bills) These securities have sovereign guarantee and are available with long maturity period. Thus fixed income over long period is assured. Interest on such securities are taxable (unless declared as tax free). There is no TDS. Presently 10 year maturity G-Sec yield is 6.126%. Such purchases can be made through NSE broker or using NSE goBID mobile app.

- There are few insurance products (from LIC as well as private insurers) that provide –

- Life cover upto 85 years (few insurance companies offer even upto 100 years)

- Fixed annual / half yearly / quarterly / monthly income

- Rate of return hover around 5.5%

- Longer maturity period of upto 30 years

A retiree’s advice to the younger generation

A retired person has a huge life experience. Sharing his/her money management thoughts with youngsters will definitely help youngsters steer skillfully their life’s financial journey:

- Have a household budget to keep expenses under control. Most of the billionaires maintain expense budget.

- Keep emergency funds upto 6 months of your monthly expense.

- Have financial goals for life’s various milestones including retirement and direct your savings towards it.

- Buy house early in life and repay the housing loan much before retirement.

- Understand your risk appetite and invest in different asset classes to realise your financial goals.

- Have a life and health insurance policy.

- Do not mix investment with insurance policy.

- Leverage your personal finance. Take loans where it is justified e.g. home , higher education. However, keep your monthly loan repayment obligations upto 35% of monthly income.

Author Bio

Rishi Khator (FCA, CPA, CIFRS) is Chartered Accountant based in Kolkata. He is author of the book on Personal Finance – Right Now : How to be Financially Strong plus Happy All Along. He believes Financial Literacy is a critical like skill. He has been propagating it through workshops, events and his writings. He has reached out to working adults, college students, school children and homemakers for creating awareness in Financial Literacy.

He is also founder and partner of Chunder Khator & Associates, Chartered Accountants. The firm presently has operations in Kolkata, Mumbai, Singapore and Bangkok.

Very much helpful Rishi… really am more enlightened now after going through the above writing…will surely need your help in some of my investments re…hope you will oblige…

Very well explained.

Very informative.

How to be finnacaly strong and be happy

A good article to create awareness on how to make use of one’s hard earned money in different stages of life, especially post retirement! A wise thought to keep the the financial stress in bay!!

Very very useful, I have already been using senior citizen savings schemes since April 2021

Very well explained and need of the hour.

Financial literacy as explained by Mr. Rishi Khator(FCA,CPA,CIFRS)of Kolkata is marvelous. Masterly,he has given solutions to all the financial problems of old age. One who is financially literate and has acted upon in one’s life will never say ‘I am tired and retired Thank you